When Betsy DeVos’s term as education secretary ended in January, so did her crusade to expand federal funding for private school choice. She failed to achieve that goal but a provision in the Tax Cuts and Jobs Act of 2017 has quietly produced hundreds of millions of dollars in tax subsidies for private school tuition, according to data we’ve researched and collected for the first time.

DeVos claimed that the “biggest winners” of her failed private school scholarship plan would be “America’s forgotten children, who will finally have choices previously available only for the rich.” The 2017 measure, though, has primarily helped wealthier families pay for private and parochial schools.

The federal government established so-called 529 college savings plans in 1996 to help families cover college costs. (It’s named for Sec. 529 of the tax code.) They’re a bit like IRAs, except for education. Families invest in state-administered mutual funds (up to $30,000 a year for married couples), where their money grows tax-free. They then withdraw funds to pay college tuition and related expenses, again free of federal taxes on their capital gains. Depending on where the contributor lives they might earn an additional state tax break.

The 2017 tax law dramatically extended the 529 program to elementary and secondary education, permitting families to use up to $10,000 in 529 funds per year per child to pay for private and parochial school tuition and related expenses. That’s a boon to wealthier families because they’re more likely to have the resources to invest in the expanded 529 plans, and thus more likely to reap the tax advantages of sending their children to private schools.

The provision was slipped into the 2017 bill late by Texas Republican Sen. Ted Cruz. The National Association of State Treasurers, which represents the state officials who administer 529 plans, was concerned that the provision was “just for rich people, people who can afford tuition,” Chris Hunter, the organization’s deputy director, told us.

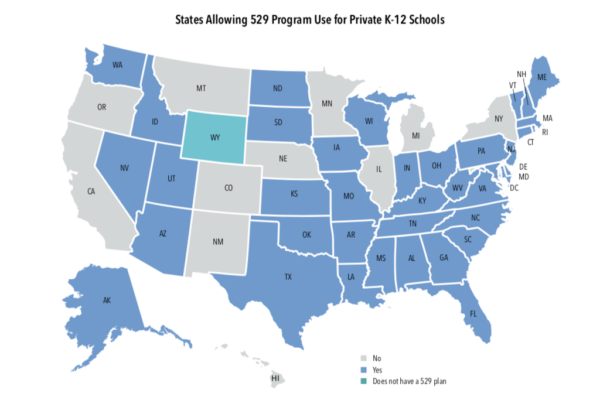

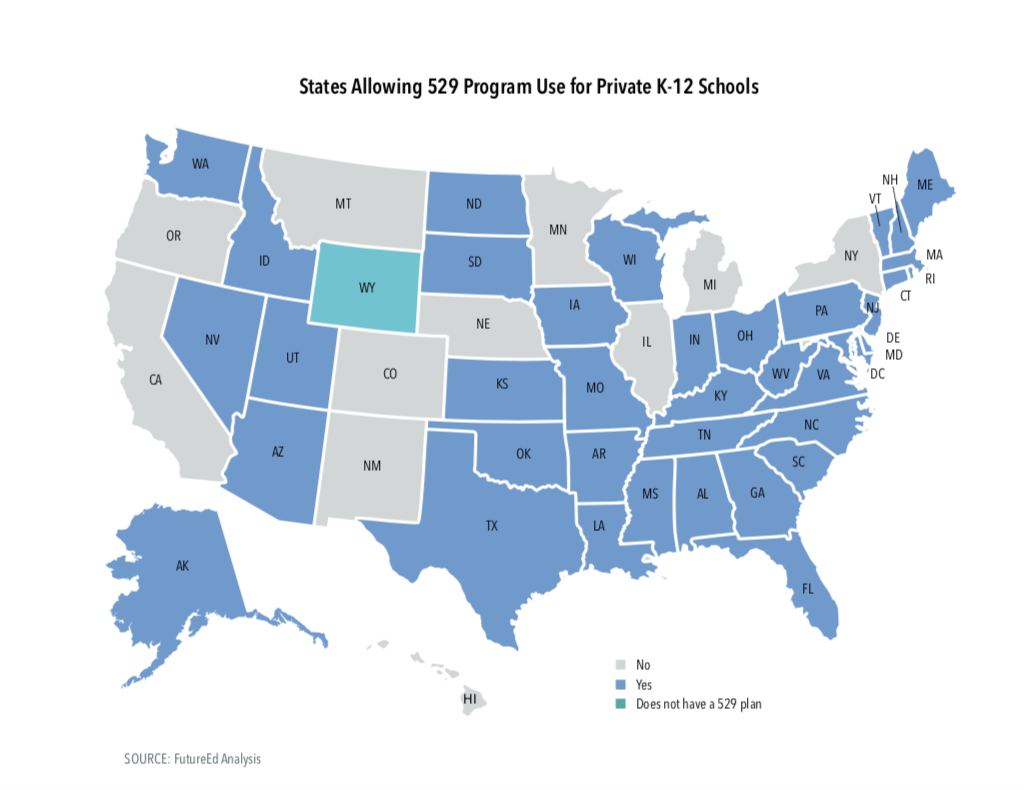

Forty-nine states and the District of Columbia sponsor 529 plans. (Wyoming is the exception) Thirty-eight of them and D.C. have adopted the K-12 private school expansion so far. With the cost of some private schools rivaling that of the nation’s most expensive colleges (tuition and fees at The Lawrenceville School in New Jersey, for example, are over $70,000 this year), the windfall for the wealthy is spreading.

Yes, the funds can be applied toward more reasonably priced institutions, such as parochial schools. But as with 529 withdrawals used for college this skews upward.

After the president signed the 2017 tax law, it’s no surprise that one commentator said “it would be financial malpractice for accountants and financial advisers not to be recommending to clients that they consider this kind of upfront investment” in their children’s private elementary and secondary education.

There were 14.8 million accounts with some $425 billion invested in 529 plans nationally at the end of 2020, Hunter of the National Association of State Treasurers reports, up from 13.8 million accounts valued at $311 billion at the end of 2018

Only Louisiana tracks K-12 and higher education 529 expenditures separately. There, families have withdrawn approximately $6 million for K-12 school expenses over three years. But by identifying 529 money withdrawn for beneficiaries age 17 or younger—the population mostly likely to be in elementary and secondary schools—the extent of the private school tuition tax break becomes clearer.

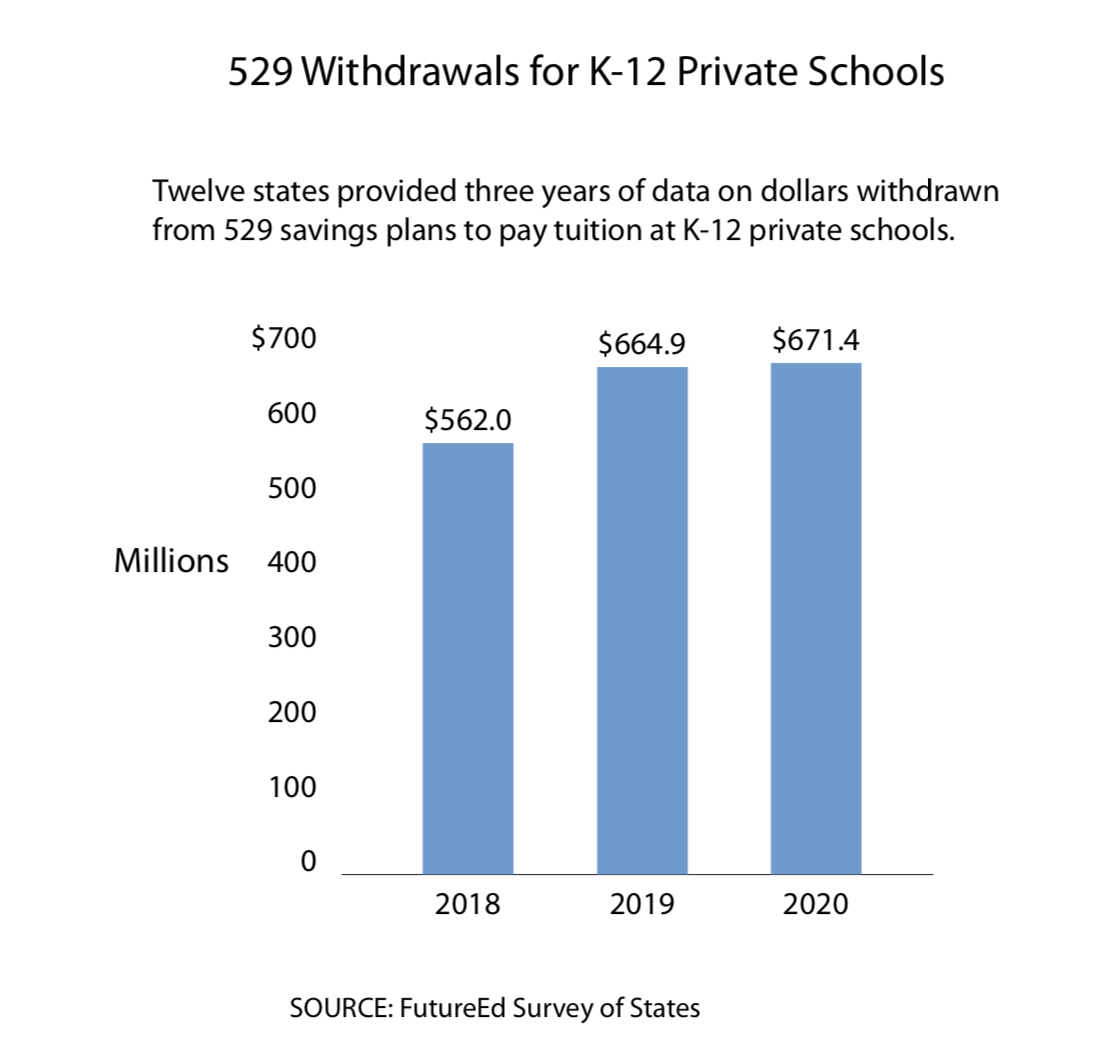

Twelve states shared with us that detailed information for the past three years and the numbers were striking: Families cashed  out $1.9 billion in private elementary and secondary school payments during that period, $562 million in 2018, $665 million in 2019, and $671 million in 2020.

out $1.9 billion in private elementary and secondary school payments during that period, $562 million in 2018, $665 million in 2019, and $671 million in 2020.

Families in North Carolina’s plan redeemed $8.9 million for beneficiaries 17 or younger in 2020, up from $3.4 million in 2018. Withdrawals from the Maryland program rose from $44 million to $50 million during the same period. And Maine reported a whopping $320 million in withdrawals for beneficiaries 17 and under in 2020 alone.

Because a majority of 529 plans don’t require participating families to be state residents and don’t require participating students to attend in-state schools, the money from the 12 states in our analysis flowed to private schools throughout the country. Maine’s plan, for instance, is operated by the investment firm Merrill Lynch and offered to families nationwide.

Using modest estimates of market returns and the length of investments and scaling the $1.9 billion in 529 withdrawals for school expenses in the dozen states to create a national picture, the Cruz provision easily has generated hundreds of million dollars in tax breaks to date, according to Hunter. It’s still a fraction of post-secondary withdrawals but it seems likely to grow as more parents and guardians become aware of the benefits.

Late in 2019, President Trump signed the Secure Act, expanding 529 programs to cover apprenticeship costs and to pay off college loans, a move that extends 529 benefits to the working-class students who gravitate to apprenticeships and take on college debt. But the move is unlikely to help those students very much, because students who borrow to attend post-secondary programs are doing so because they lack the resources they would need to fund 529 accounts.

Ultimately, tax breaks on savings accounts whether for colleges or primary and secondary schools are a middle- and upper-class benefit. Recognizing that it’s not an effective way to help lower income students get an education is important to remember as pressure grows to raise the caps on contributions. They’re a way, as the saying goes, for the rich to get richer.

This piece was published in Washington Monthly.